The Sifter Fund Net Asset Value (NAV) increased by 34.3% in 2021.

This was the best year in the Fund’s history. The Fund return outperformed the global equity index (MSCI ACWI, Eur) by 6.8 percent. The institutional, PI class, rose even more, by 34.8%, beating the market index by as much as 7.3%.

During the year, we analyzed 54 potential quality companies out of more than 65,000 companies. We ended up investing in only two new companies, Sony and Nitori in Japan, which we believe improved the price-quality ratio of the Sifter portfolio.

In addition, we made more than one percent weight additions to five existing portfolio companies. We financed the new investments by receiving new subscriptions and by selling entirely three of our portfolio companies (iRobot, Oracle, Ain Holdings). In addition, we reduced weight, more than one percent, of the three existing investments.

Which quality companies were the top gainers? Read our annual summary.

The Sifter portfolio is ready for 2022

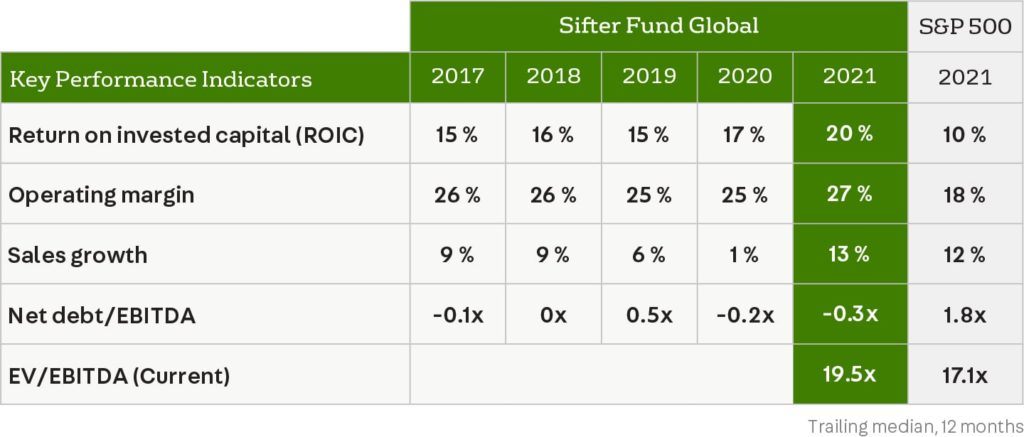

The business indicators of the Sifter companies further strengthened in 2021. For example, The Return on Invested Capital (ROIC) of the Sifter portfolio companies rose to 20%, which is twice as good as that of the S&P 500 median companies. In light of the key metrics, the companies in the Sifter portfolio are in a good shape and prepared for 2022.